| Legislative Updates |

Updated 11.1.24

CHANGES DUE TO HEALTHCARE REFORM

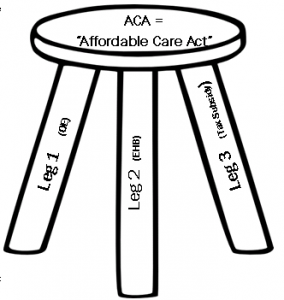

Signed into law in March of 2010, the Affordable Care Act (ACA) has been the most life-changing law since the passing of Medicare in the 1960s. The ACA shaped new rules and guidelines went into effect January 1, 2014.

NOW... we individuals, under the age of 65, who are NOT on a group policy have become a group of our own. We have a once a year “Open Enrollment” (OE) period, just like our seniors do. Outside of this annual OE we will ONLY BE ELIGIBLE for coverage through a Qualified Life Event (QLE) for example birth, marriage, loss of employer coverage, etc. which creates a Special Enrollment Period (SEP).

WHATS NEW IN 2025'S (10TH ANNUAL OPEN ENROLLMENT) UNDER AGE 65 AMERICANS SHOPPING FOR 2025'S "AFFORDABLE CARE ACT" PLANS?

Humana pulled out of health market. The marketplace made the decision that there were too many plan options available to customers. Expecting more rate increases, we don't see the NEW carriers that were promised coming into the plans, therefore, the old carriers are getting approved at a higher rate. NEW carriers are joining the game this year for the 2024 OE and there is an extended open enrollment this year for 2025 until 1.15.25 for an effective date of 2.1.25. The "Covid Cares Act" tax subsidy increase will be maintained this year. The deductibles will increase again! The max out-of-pocket (OOP) for individuals will also increase to $8,700 and the max OOP for families will increase to $17,400. This will also happen on group plans for these ObamaCare ACA plans. And YES, the rates will go up again this year.

Sadly the rates just keep rising. The #1 issue with ACA plan designs, for the individual markets, lies in the actual proposed benefit of having such a plan design that is:

- A Guaranteed Issue design with no preexisting condition

- Includes the Essential Health Benefits (EHB's)

- The once a year open enrollment

The plan and its design was and is the actual cause for its failure. Sadly, the only healthy Americans participating are only those who are eligible for a Tax Subsidy to lower their premium.

The others who are willing to pay the outrageous premiums for these anything but "affordable" care act policies are the sick Americans who need a policy that does in fact cover their preexisting conditions and is affordable. Yet they've now had rate hikes of up to 400-800% in just 8 years.

Please contact our office for more information on the 2025 strategy that best serves you and your family's needs.

See below to better understand Healthcare Reform and how it might affect you and/or your family and how its already affected America.

WHEN IS OPEN ENROLLMENT?2025 plans will become available at open enrollment which starts for the under 65 market on November 1, 2024. The enrollment deadline for a January 1, 2025 effective date is December 15, 2024. Beginning December 16, 2024 the open enrollment period will be closed and only Qualified Life Events (QLE) will allow you to become eligible for a Special Enrollment Period (SEP) in 2024 for the 2025 plan design. 2025 Plan Designs for this Ninth Annual Open Enrollment (OE) has the following deadlines:

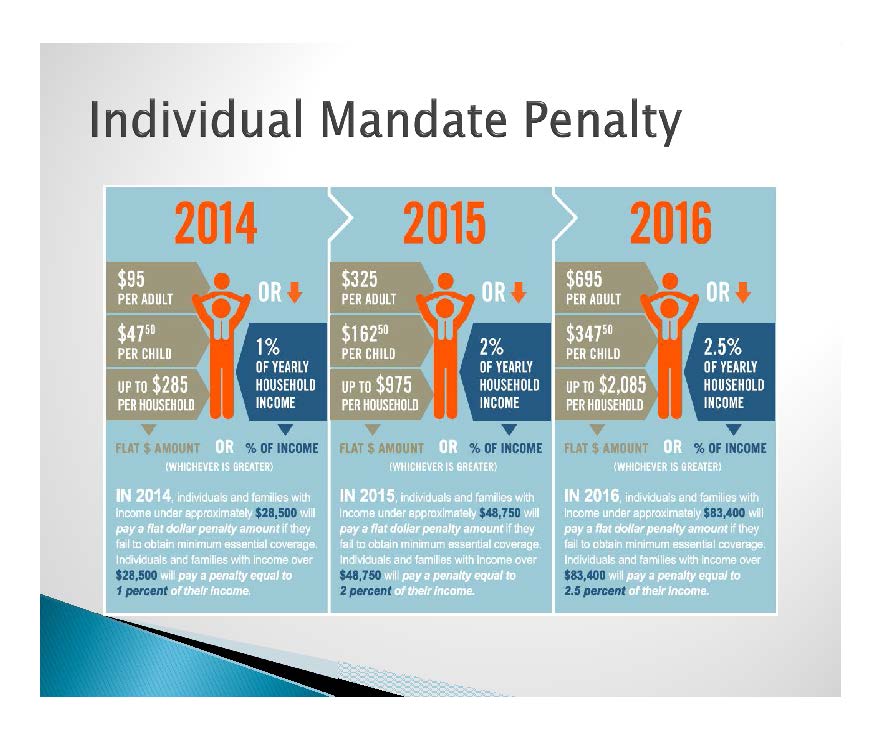

Note: The Tax Penalty was part of the ACA Bill and is part of the ACA law. The ACA Law hasn't been changed, What has been changed is ... In October of 2017 President Trump implemented an Executive Order through the "Department of Labor" stating that the "Executive Branch, to the extent consistent with law, to will facilitate the purchase of insurance across State Lines and the development and operation of a healthcare system that provides high-quality care at affordable prices for the American people." To see the whole executive order please click here.

HIT = Health Insurance Tax:Begun in 2014, there are new levies on health insurance companies and individual tax payers to fund the health care law. The biggest tax is known as HIT - the health insurance tax. This is a multi-billion-dollar assessment on some health insurance companies based on their market share. The first year the total was expected to be $8 billion. By 2018, the amount grew to over $14.3 billion. A 2011 study by the consulting firm Oliver Wyman confirmed the tax will increase premiums by more than $2,800 per person and $6,800 per family over 10 years. Individuals making more than $200,000 and couples making more than $250,000 began to pay a 3.8 percent tax on dividends and capital gains when they file their 2013 returns. For the first three years, insurers paid approximately $63 per health insurance recipient - a temporary "reinsurance fee." The $12 billion collected was to be used to spread out risk so insurance companies that end up taking on the most costly patients will be protected. Insurance companies however simply pulled out of the market so this was another epic fail!

|

NOTE: In Florida, due to state laws protecting consumers, a licensed agent must be used to sell a consumer an ACA compliant insurance plan. Some tax subsidized clients are also eligible for "cost share" which alters the plan selected according to eligibility. Michele Powell NPN # 524829

WHAT COVERAGES ARE AVAILABLE AT THE MARKETPLACE?

The new Marketplace "Federal" or "State" (also called the “Exchange”) offers one of four tax subsidized plans, namely:

|

PLANS |

|

Bronze |

|

Silver |

|

Gold |

|

Platinum |

Most states also offer a catastrophic plan, for those under 30 or who can show a financial hardship to be eligible through the Marketplace.

NOTE: The Government Tax Subsidies and out-of-pocket assistance for those with low incomes are ONLY available through the Marketplace. Florida does not have a State "Exchange," therefore, anyone "tax subsidy eligible" must apply through the Federal Exchange and should request their licensed ACA compliant agent for representation and service throughout the year.

WHAT ARE GOVERNMENT SUBSIDIES?

Those who are "subsidy eligible" are those who are considered by the federal government to be unable to afford health coverage. The new law will provide assistance in the form of tax credits/subsidies AND help with out of-pocket health expenses. These “Subsidies” will be made available based on how a family’s gross income compares to the national Federal Poverty Level (FPL).

Individuals and families with incomes between 100 and 400 percent of the FPL will qualify for tax credits to reduce the premiums for health insurance purchased through the Marketplace aka Exchanges. In addition, those with incomes from 100 to 250 percent of the FPL will qualify for help in paying out-of-pocket costs for the co-pays and deductibles not covered by their health insurance.

In 2024 the FPL for a one-person household is $15,060.

To view the 2024 Federal poverty level (FPL) chart please click the link below: Print if needed.

Please click HERE 2024 Federal Poverty Level Chart

NOTE: If your employer offers affordable health insurance to their employees, you most likely will NOT qualify for a subsidy.

If you have employer-provided insurance, your family members can shop on the marketplace, but may not qualify for subsidies, which are based on the family income.

Just like we Americans all go to the same grocery stores, and some of us pay with CASH while others pay with FOOD STAMPS (aka EBT cards), the health insurance market is the same. We all will go to the same carriers and be offered the same policies however those who are eligible for a tax subsidy will pay for their premium, all or partial with a HEALTH TAX SUBSIDY. For example: A policy that costs $800 a month will cost those "OFF" the Exchange $800. Those who purchase that same policy who are eligible for a tax subsidy will be considered "ON" the Exchange and will take their tax subsidy of lets say $300 a month and reduce their $800 a month premium down to $500 and that is what the carrier will actually charge them for. The "Tax Subsidy" will pay the carrier the balance and the consumer who qualifies for the "Tax Subsidy" will take it up with the IRS at the end of the year.

If the consumer who took the subsidy did not actually qualify for the $300 estimated subsidy, then they will have to pay it back in the form of a tax adjustment at the end of the year. If they qualified for more, the subsidy adjustment will be made accordingly.

NOTE: The "tax subsidy" is aka (also known as) purchasing an "ON Exchange" ACA compliant plan.

WHAT WILL THESE PLANS COST?

Carriers are joining the marketplace annually and each have announced rate increases again this year. Some who had left the marketplace due to significant losses incurred from these guaranteed issue plans with the 10 Essential Health Benefits now are coming back.

ARE THERE ANY ALTERNATIVES?

The simple answer is: Yes. Please call our office to discuss an "Alternative" that best serves you and your family and to see if you'll be eligible.

IS MY EMPLOYER REQUIRED TO PROVIDE ME COVERAGE?

If your employer offers insurance or a family healthcare plan, you can obtain coverage through your workplace. Employers with more than 51 employees will be required to automatically enroll their employees in a company-provided healthcare plan eventually (or face penalties). An alternative to employer-provided coverage would be to obtain it through “exchanges,” which are policy marketplaces operated and regulated on a state or federal level that offer individual and family healthcare policies and coverage options. Employers with 49 or fewer full-time employees are NOT required to offer coverage to their employees.

WHAT IF I DON’T HAVE EMPLOYER PROVIDED HEALTH INSURANCE AND CAN’T AFFORD TO BUY FROM THE “PRIVATE MARKET” OR “GOVERNMENT MARKETPLACE”?

You may be eligible for a government assistance plan that you most likely have always been eligible for. They are:

- MEDICARE

- (for the over 65 market)

- Annual Enrollment Period (AEP) is 10/15/24 to 12/7/24

- Open Enrollment Period (OEP) is 1/1/25 to 3/31/25 (only for people who are already in a Med Adv plan that wants to make changes to either go back on regular Medicare and an Rx plan or another Med Adv plan. It does not guarantee enrollment into a supplement.

- Our Medicare Specialists will be happy to assist you

- Simply call our office at 941-753-0031

- MEDICAID

- Questions? Call 1-800-318-2596, 24 hours a day, 7 days a week. (TTY: 1-855-889-4325)

- CHIP (Children’s Health Insurance Program)

- Questions? Call 1-800-318-2596, 24 hours a day, 7 days a week. (TTY: 1-855-889-4325)

- TRI-CARE

- The health care program serving Uniformed Service members, retirees and their families worldwide

- www.hnfs.com

- 1-877-TRICARE (1-877-874-2273)

If you’re still confused, you are certainly not alone – the map link below will display one of the cleanest attempts to simplify the“New Paths To Health Insurance” we've found. Simplified?

Please click HERE to see map.

HELPFUL LINKS

U.S. Department of Labor, Affordable Care Act Regulations and Guidance

Law Language - Sec 1501, page 148 addresses the exemption.

Summary of the Affordable Care Act - from Kaiser Family Foundation

The following information is provided by National Association of Health Underwriters (www.nahu.org)

Back in 2010 NAHU assembled two charts (click on Adobe links below) to help explain the timeline for implementation of the law.

The first is a very detailed chart for your reference that explains how all of the new health insurance reforms in both the Senate bill

and the reconciliation bill will impact private health insurance organized by effective date. The second chart is a simplified timeline

that explains how both pieces of health care reform legislation will impact your individual and employer clients. Please feel free to

use these documents as part of your business and distribute them to clients if you wish. The third icon is the Healthcare Reform

Timeline.

Click this icon for the Simplified Chart

Click this icon for the Detailed Chart

Click this icon for the Healthcare Reform Timeline